The Only Guide for Identity Theft Protection From Experian

If you're concerned about information breaches or identity theft, you may be thinking about signing up for identity theft protection services. Prior to you enroll, it is essential to weigh the costs and benefits of numerous types of services. You also can compare them with totally free and low-priced services. The federal government's IdentityTheft.

Many companies describe their services as identity theft protection services. In reality, no service can protect you from having your individual info taken. What these companies offer are monitoring and healing services. Monitoring services look for indications that an identity burglar may be utilizing your individual information. Recovery services assist you deal with the impacts of identity theft after it happens.

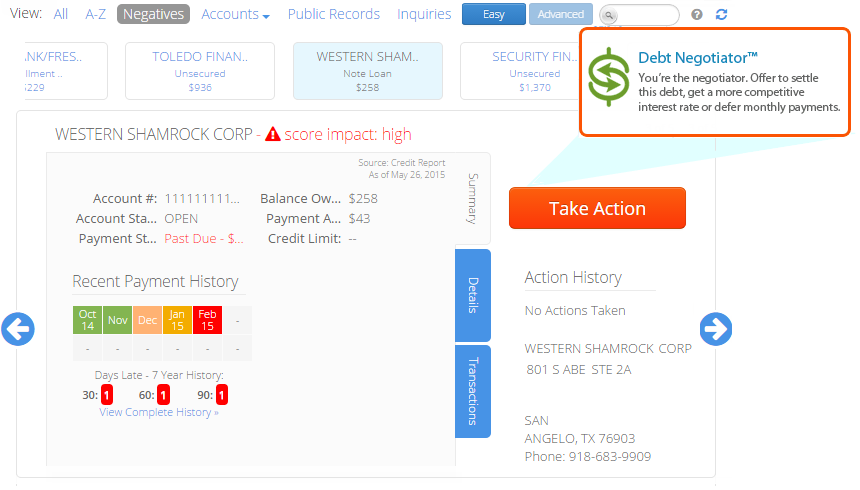

There are 2 standard kinds of keeping track of services credit best 3 credit report monitoring monitoring and identity tracking. tracks activity on your credit reports at one, two, or all 3 of the major credit bureaus Equifax, Experian, and TransUnion. If you area activity that might result from identity theft or an error, you can take actions to deal with the problem prior to it grows.

Rumored Buzz on How Can I Check My Identity Theft For Free?

However many types of identity theft will not appear. For example, credit monitoring https://en.wikipedia.org/wiki/?search=check credit score will not inform you if an identity burglar withdraws cash from your bank account, or utilizes your Social Security number to submit an income tax return and gather your refund. Some services just monitor your credit report at one of the credit bureaus - credit monitoring companies.

Rates for credit monitoring vary widely, so it pays to search. Questions to ask credit monitoring provider: Which credit bureaus do you keep an eye on? How typically do you keep track of reports? Some display daily; others are less frequent. What gain access to will I have to my credit reports? Can I see my reports at all three credit bureaus? Is there a limit to how typically I can see my reports? Will I be charged a separate charge each time I see a report? Are other services consisted of, such as access to my credit rating? signals you when your individual information like your checking account info or http://identitytheftprotectionserviceswbus411.wpsuo.com/the-ultimate-guide-to-can-thieves-steal-your-home-title Social Security, motorist's license, passport, or medical ID number is being utilized in ways that generally don't appear on your credit report.

For example, they may inspect the National Modification of Address database to see if anybody is trying to redirect your mail. The efficiency of the monitoring will depend upon elements like the type of databases the service checks, how great the databases are at collecting information, and how frequently the service checks each database.

The Only Guide for Can Lifelock Be Trusted?

For example, most tracking services can't notify you to tax or federal government advantages scams, consisting of Medicare, Medicaid, welfare, and Social Security frauds. Questions to ask identity monitoring companies: What kinds of info do you check, and how typically? For instance, does the service check databases that show payday advance loan applications to see if somebody is misusing my info to get a loan? What individual information do you need from me and how will you utilize my information? Are other services included with the identity monitoring service? Do they cost extra? Identity recovery services are designed to help you regain control of your good name and finances after identity theft occurs.

They may assist you compose letters to lenders and debt collectors, position a freeze on your credit report to avoid an identity burglar from opening brand-new accounts in your name, or guide you through files you need to review. Some services will represent you in handling financial institutions or other organizations if you formally approve them authority to act upon your behalf.

The insurance normally covers only out-of-pocket expenses straight associated with reclaiming your identity. Normally, these expenses are limited to things like postage, copying, and notary expenses. Less frequently, the expenses might consist of lost incomes or legal costs. The insurance usually does not reimburse you for any stolen cash or monetary loss arising from the theft.

The Of 7 Best Identity Theft Protection Services Of 2020

Also, a lot of policies don't pay if your loss is otherwise covered by your property owner's or renter's insurance. If you have an interest in identity theft insurance, ask to see a copy of the business's conditions - credit monitoring. Here are some inexpensive or complimentary ways you can protect yourself versus identity theft: Display your credit reports totally free.

See AnnualCreditReport. com the only authorized website free of charge credit reports. If you wish to monitor your reports in time, you can spread out your requests, getting one totally free report every four months. Evaluation statements for your credit card, bank, retirement, brokerage, and other accounts each month. Or log in and inspect them even more often.