How Identity Theft Protection Services can Save You Time, Stress, and Money.

If you're worried about data breaches or identity theft, you might be considering registering for identity theft protection services. Prior to you register, it is essential to weigh the costs and advantages of numerous types of services. You likewise can compare them with complimentary and low-cost services. The federal government's IdentityTheft.

Lots of companies describe their services as identity theft protection services. In reality, no http://www.bbc.co.uk/search?q=check credit score service can secure you from having your individual details stolen. What these business offer are keeping track of and healing services. Monitoring services look for indications that an identity thief might be using your personal details. Healing services assist you deal with the effects of identity theft after it happens.

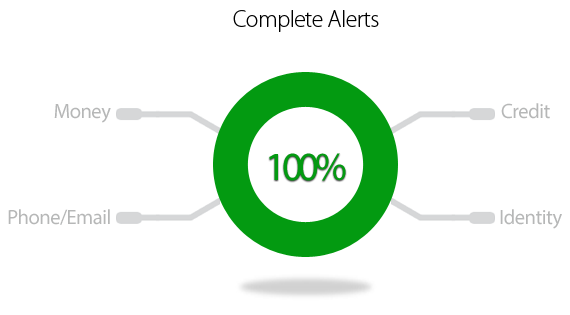

There are 2 standard types of keeping an eye on services credit monitoring and identity tracking. tracks activity on your credit reports at one, 2, or all three of the significant credit bureaus Equifax, Experian, and TransUnion. If you spot activity that may result from identity theft or an error, you can take steps to solve the issue before it grows.

Some Known Incorrect Statements About How Can I Secure My Identity Online?

But numerous types of identity theft won't appear. For instance, credit monitoring won't tell you if an identity burglar withdraws cash from your savings account, or utilizes your Social Security number to file an income tax return and gather your refund. Some services only monitor your credit report at one of the credit bureaus - identity theft protection.

Prices for credit monitoring differ extensively, so it pays to search. Questions to ask credit monitoring service suppliers: Which credit bureaus do you monitor? How often do you keep an eye on reports? Some display daily; others are less frequent. What gain access to will I have to my credit reports? Can I see my reports at all three credit bureaus? Is there a limit to how frequently I can see my reports? Will I be charged a separate cost each time I view a report? Are other services included, such as access to my credit rating? alerts you when best free credit score your individual info like your checking account information or Social Security, driver's license, passport, or medical ID number is being utilized in manner ins which usually do not show up on your credit report.

For instance, they might examine the National Change of Address database to see if anyone is trying to redirect your mail. The effectiveness of the tracking will depend on aspects like the kinds of databases the service checks, how excellent the databases are at collecting information, and how frequently the service checks each database.

The Ultimate Guide To How Can I Protect My Identity And Credit?

For instance, the majority of tracking services can't notify you to tax or federal government advantages fraud, consisting of Medicare, Medicaid, well-being, and Social Security frauds. Questions to ask identity monitoring service providers: What kinds of information do you check, and how often? For example, does the service check databases that reveal payday loan applications to see if somebody is misusing my information to get a loan? What individual info do you require from me and how will you utilize my info? Are other services included with the identity tracking service? Do they cost extra? Identity healing services are developed to help Browse around this site you regain control of your good name and financial resources after identity theft happens.

They may help you write letters to creditors and financial obligation collectors, put a freeze on your credit report to avoid an identity burglar from opening brand-new accounts in your name, or guide you through documents you have to review. Some services will represent you in handling creditors or other organizations if you officially give them authority to act on your behalf.

The insurance generally covers only out-of-pocket expenses straight related to reclaiming your identity. Generally, these costs are restricted to things like postage, copying, and notary costs. Less often, the expenses may consist of lost incomes or legal fees. The insurance usually doesn't repay you for any stolen cash or financial loss resulting from the theft.

Things about How Can I Protect My Identity And Credit?

Also, the majority of policies do not pay if your loss is otherwise covered by your homeowner's or renter's insurance coverage. If you're interested in identity theft insurance, ask to see a copy of the company's terms and conditions - credit monitoring companies. Here are some affordable or totally free ways you can safeguard yourself against identity theft: Display your credit reports totally free.

Go to AnnualCreditReport. com the only authorized site totally free credit reports. If you wish to monitor your reports with time, you can spread out your demands, getting one complimentary report every 4 months. Evaluation statements for your credit card, bank, retirement, brokerage, and other accounts monthly. Or log in and check them a lot more often.