The Only Guide for Identity Theft Protection From Experian

If you're concerned about information breaches or identity theft, you may be thinking about signing up for identity theft protection services. Prior to you enroll, it is essential to weigh the costs and benefits of numerous types of services. You also can compare them with totally free and low-priced services. The federal government's IdentityTheft.

Many companies describe their services as identity theft protection services. In reality, no service can protect you from having your individual info taken. What these companies offer are monitoring and healing services. Monitoring services look for indications that an identity burglar may be utilizing your individual information. Recovery services assist you deal with the impacts of identity theft after it happens.

There are 2 standard kinds of keeping track of services credit best 3 credit report monitoring monitoring and identity tracking. tracks activity on your credit reports at one, two, or all 3 of the major credit bureaus Equifax, Experian, and TransUnion. If you area activity that might result from identity theft or an error, you can take actions to deal with the problem prior to it grows.

Rumored Buzz on How Can I Check My Identity Theft For Free?

However many types of identity theft will not appear. For example, credit monitoring https://en.wikipedia.org/wiki/?search=check credit score will not inform you if an identity burglar withdraws cash from your bank account, or utilizes your Social Security number to submit an income tax return and gather your refund. Some services just monitor your credit report at one of the credit bureaus - credit monitoring companies.

Rates for credit monitoring vary widely, so it pays to search. Questions to ask credit monitoring provider: Which credit bureaus do you keep an eye on? How typically do you keep track of reports? Some display daily; others are less frequent. What gain access to will I have to my credit reports? Can I see my reports at all three credit bureaus? Is there a limit to how typically I can see my reports? Will I be charged a separate charge each time I see a report? Are other services consisted of, such as access to my credit rating? signals you when your individual information like your checking account info or http://identitytheftprotectionserviceswbus411.wpsuo.com/the-ultimate-guide-to-can-thieves-steal-your-home-title Social Security, motorist's license, passport, or medical ID number is being utilized in ways that generally don't appear on your credit report.

For example, they may inspect the National Modification of Address database to see if anybody is trying to redirect your mail. The efficiency of the monitoring will depend upon elements like the type of databases the service checks, how great the databases are at collecting information, and how frequently the service checks each database.

The Only Guide for Can Lifelock Be Trusted?

For example, most tracking services can't notify you to tax or federal government advantages scams, consisting of Medicare, Medicaid, welfare, and Social Security frauds. Questions to ask identity monitoring companies: What kinds of info do you check, and how typically? For instance, does the service check databases that show payday advance loan applications to see if somebody is misusing my info to get a loan? What individual information do you need from me and how will you utilize my information? Are other services included with the identity monitoring service? Do they cost extra? Identity recovery services are designed to help you regain control of your good name and finances after identity theft occurs.

They may assist you compose letters to lenders and debt collectors, position a freeze on your credit report to avoid an identity burglar from opening brand-new accounts in your name, or guide you through files you need to review. Some services will represent you in handling financial institutions or other organizations if you formally approve them authority to act upon your behalf.

The insurance normally covers only out-of-pocket expenses straight associated with reclaiming your identity. Normally, these expenses are limited to things like postage, copying, and notary expenses. Less frequently, the expenses might consist of lost incomes or legal costs. The insurance usually does not reimburse you for any stolen cash or monetary loss arising from the theft.

The Of 7 Best Identity Theft Protection Services Of 2020

Also, a lot of policies don't pay if your loss is otherwise covered by your property owner's or renter's insurance. If you have an interest in identity theft insurance, ask to see a copy of the business's conditions - credit monitoring. Here are some inexpensive or complimentary ways you can protect yourself versus identity theft: Display your credit reports totally free.

See AnnualCreditReport. com the only authorized website free of charge credit reports. If you wish to monitor your reports in time, you can spread out your requests, getting one totally free report every four months. Evaluation statements for your credit card, bank, retirement, brokerage, and other accounts each month. Or log in and inspect them even more often.

How Do You Stop Identity Theft? Fundamentals Explained

If you're concerned about information breaches or identity theft, you may be considering signing up for identity theft protection services. Prior to you register, it is necessary to weigh the expenses and advantages of various types of services. You also can compare them with totally free and inexpensive services. The federal government's IdentityTheft.

Lots of companies describe their services as identity theft protection services. In reality, no service can protect you from having your personal details stolen. What these business use are keeping track of and healing services. Tracking services enjoy for indications that an identity thief might be using your personal details. Healing services assist you deal with the results of identity theft after it takes place.

There are 2 standard kinds of keeping an eye on services credit monitoring and identity tracking. tracks activity on your credit reports at one, 2, or all 3 of the significant credit bureaus Equifax, Experian, and TransUnion. If you area activity that might result from identity theft or a mistake, you can take steps to solve the problem prior to identity theft protection cost it grows.

An Unbiased View of Can Lifelock Be Trusted?

But lots of types of identity theft won't appear. For instance, credit monitoring won't tell you if an identity burglar withdraws cash from your checking account, or utilizes your Social Security number to submit an income tax return and gather your refund. Some services only monitor your credit report at one of the credit bureaus - identity theft monitoring.

Rates for credit monitoring differ commonly, so it pays to look around. Concerns to ask credit monitoring company: Which credit bureaus do you keep track of? How typically do you keep track of reports? Some monitor daily; others are less frequent. What gain access to will I need to my credit reports? Can I see my reports at all three credit bureaus? Is there a limitation to how frequently I can see my reports? Will I be charged a separate charge each time I view a report? Are other services included, such as access to my credit rating? notifies you when your individual information like your bank account information or Social Security, motorist's license, passport, or medical ID number is being utilized in methods that usually do not appear on your credit report.

For example, they might check the National Change of Address database to see if anybody is trying to reroute your mail. The effectiveness of the monitoring will depend on aspects like the sort of databases the service checks, how great the databases are at gathering information, and how often the service checks each database.

Excitement About 7 Best Identity Theft Protection Services Of 2020

For instance, most tracking services can't inform you to tax or government benefits scams, including Medicare, Medicaid, well-being, and Social Security scams. Questions to ask identity monitoring providers: What kinds of info do you inspect, and how frequently? For example, does the service check databases that reveal payday advance applications to see if someone is misusing my details to get a loan? What individual information do you require from me and how will you utilize my info? Are other services consisted of with the identity tracking service? Do they cost additional? Identity healing services are designed to assist you restore control of your great name and finances after identity theft happens.

They might help you write letters to creditors and financial obligation collectors, put a freeze on your credit report to avoid an identity burglar from opening brand-new accounts in your name, or guide you through files you have to evaluate. Some services will represent you in handling creditors or other organizations if you formally grant them authority to act upon your behalf.

The insurance typically covers just out-of-pocket costs straight associated with reclaiming your identity. Normally, these expenditures are limited to things like postage, copying, and notary expenses. Less typically, the expenditures might consist of lost incomes or legal charges. The insurance coverage typically doesn't reimburse you for any stolen money or monetary loss resulting from the theft.

8 Simple Techniques For Can Thieves Steal Your best 3 credit report monitoring Home Title?

Likewise, the majority of policies don't pay if your loss is otherwise covered by your homeowner's or renter's insurance. If you're interested in identity theft insurance, ask to see a copy of the company's terms - identity theft monitoring. Here are some low-priced or complimentary ways you can secure yourself versus identity theft: Screen your credit reports free of charge.

Visit AnnualCreditReport. com the only authorized site for complimentary credit reports. If you want to monitor your reports in time, you can expand your requests, getting one totally free report every 4 months. Review statements for your credit card, bank, retirement, brokerage, and other accounts on a monthly basis. Or log in and examine them even more frequently.

How Identity Theft Protection Services can Save You Time, Stress, and Money.

If you're worried about data breaches or identity theft, you might be considering registering for identity theft protection services. Prior to you register, it is essential to weigh the costs and advantages of numerous types of services. You likewise can compare them with complimentary and low-cost services. The federal government's IdentityTheft.

Lots of companies describe their services as identity theft protection services. In reality, no http://www.bbc.co.uk/search?q=check credit score service can secure you from having your individual details stolen. What these business offer are keeping track of and healing services. Monitoring services look for indications that an identity thief might be using your personal details. Healing services assist you deal with the effects of identity theft after it happens.

There are 2 standard types of keeping an eye on services credit monitoring and identity tracking. tracks activity on your credit reports at one, 2, or all three of the significant credit bureaus Equifax, Experian, and TransUnion. If you spot activity that may result from identity theft or an error, you can take steps to solve the issue before it grows.

Some Known Incorrect Statements About How Can I Secure My Identity Online?

But numerous types of identity theft won't appear. For instance, credit monitoring won't tell you if an identity burglar withdraws cash from your savings account, or utilizes your Social Security number to file an income tax return and gather your refund. Some services only monitor your credit report at one of the credit bureaus - identity theft protection.

Prices for credit monitoring differ extensively, so it pays to search. Questions to ask credit monitoring service suppliers: Which credit bureaus do you monitor? How often do you keep an eye on reports? Some display daily; others are less frequent. What gain access to will I have to my credit reports? Can I see my reports at all three credit bureaus? Is there a limit to how frequently I can see my reports? Will I be charged a separate cost each time I view a report? Are other services included, such as access to my credit rating? alerts you when best free credit score your individual info like your checking account information or Social Security, driver's license, passport, or medical ID number is being utilized in manner ins which usually do not show up on your credit report.

For instance, they might examine the National Change of Address database to see if anyone is trying to redirect your mail. The effectiveness of the tracking will depend on aspects like the kinds of databases the service checks, how excellent the databases are at collecting information, and how frequently the service checks each database.

The Ultimate Guide To How Can I Protect My Identity And Credit?

For instance, the majority of tracking services can't notify you to tax or federal government advantages fraud, consisting of Medicare, Medicaid, well-being, and Social Security frauds. Questions to ask identity monitoring service providers: What kinds of information do you check, and how often? For example, does the service check databases that reveal payday loan applications to see if somebody is misusing my information to get a loan? What individual info do you require from me and how will you utilize my info? Are other services included with the identity tracking service? Do they cost extra? Identity healing services are developed to help Browse around this site you regain control of your good name and financial resources after identity theft happens.

They may help you write letters to creditors and financial obligation collectors, put a freeze on your credit report to avoid an identity burglar from opening brand-new accounts in your name, or guide you through documents you have to review. Some services will represent you in handling creditors or other organizations if you officially give them authority to act on your behalf.

The insurance generally covers only out-of-pocket expenses straight related to reclaiming your identity. Generally, these costs are restricted to things like postage, copying, and notary costs. Less often, the expenses may consist of lost incomes or legal fees. The insurance usually doesn't repay you for any stolen cash or financial loss resulting from the theft.

Things about How Can I Protect My Identity And Credit?

Also, the majority of policies do not pay if your loss is otherwise covered by your homeowner's or renter's insurance coverage. If you're interested in identity theft insurance, ask to see a copy of the company's terms and conditions - credit monitoring companies. Here are some affordable or totally free ways you can safeguard yourself against identity theft: Display your credit reports totally free.

Go to AnnualCreditReport. com the only authorized site totally free credit reports. If you wish to monitor your reports with time, you can spread out your demands, getting one complimentary report every 4 months. Evaluation statements for your credit card, bank, retirement, brokerage, and other accounts monthly. Or log in and check them a lot more often.

Some Of How Can I Secure My Identity Online?

If you're worried about information breaches or identity theft, you may be considering registering for identity theft protection services. Prior to you register, it's important to weigh the costs and advantages of numerous kinds of services. You also can compare them with free and low-priced services. The federal government's IdentityTheft.

Numerous business refer to their services as identity theft protection services. In reality, no service can protect you from having your personal information stolen. What these companies use are keeping track of and healing services. Monitoring services expect signs that an identity burglar might be utilizing your individual details. Recovery services help you deal with the impacts of identity theft after it takes place.

There are two standard kinds of keeping an eye on services credit monitoring and identity monitoring. tracks activity on your credit reports at one, 2, or all 3 of the significant credit bureaus Equifax, Experian, and TransUnion. If you spot activity that may arise from identity theft or an error, you can take actions to resolve the problem prior to it grows.

Best Identity Theft Protection And Monitoring Services In 2020 - Truths

However many kinds of identity theft won't appear. For instance, credit monitoring won't tell you if an identity thief withdraws money from your bank account, or utilizes your Social Security number to submit a tax return and gather your refund. Some services just monitor your credit report at one of the credit bureaus http://query.nytimes.com/search/sitesearch/?action=click&contentCollection®ion=TopBar&WT.nav=searchWidget&module=SearchSubmit&pgtype=Homepage#/check credit score - identity theft monitoring.

Prices for credit monitoring vary commonly, so it pays to shop around. Concerns to ask credit monitoring company: Which credit bureaus do you keep an eye on? How often do you keep track of reports? Some display daily; others are less frequent. What gain access to will I need to my credit reports? Can I see my reports at all 3 credit bureaus? Exists a limit to how often I can see my reports? Will I be charged a separate cost each time credit report monitoring alert service I view a report? Are other services included, such as access to my credit rating? signals you when your personal details like your bank account information or Social Security, driver's license, passport, or medical ID number is being used in manner ins which normally do not show up on your credit report.

For example, they may examine the National Modification of Address database to see if anyone is attempting to reroute your mail. The effectiveness of the monitoring will depend on aspects like the kinds of databases the service checks, how good the databases are at collecting info, and how typically the service checks each database.

Best Identity Theft Protection & Monitoring Companies Of 2020 Can Be Fun For Everyone

For example, the majority of monitoring services can't signal you to tax or federal government benefits scams, including Medicare, Medicaid, welfare, and Social Security scams. Questions to ask identity tracking suppliers: What type of info do you inspect, and how typically? For instance, does the service check databases that reveal payday advance loan applications to see if someone is misusing my info to get a loan? What individual information do you need from me and how will you utilize my information? Are other services consisted of with the identity monitoring service? Do they cost additional? Identity healing services are developed to help you restore control of your reputation and financial resources after identity theft http://getcreditscoreiqto603.huicopper.com/the-greatest-guide-to-what-is-the-best-credit-score-app happens.

They may help you compose letters to creditors and debt collectors, put a freeze on your credit report to prevent an identity thief from opening new accounts in your name, or guide you through documents you need to review. Some services will represent you in dealing with creditors or other organizations if you officially grant them authority to act upon your behalf.

The insurance usually covers just out-of-pocket expenditures directly related to reclaiming your identity. Usually, these expenditures are restricted to things like postage, copying, and notary expenses. Less frequently, the costs may consist of lost wages or legal charges. The insurance generally doesn't reimburse you for any stolen money or financial loss arising from the theft.

Can Thieves Steal Your Home Title? for Dummies

Likewise, many policies don't pay if your loss is otherwise covered by your homeowner's or occupant's insurance coverage. If you're interested in identity theft insurance, ask to see a copy of the business's terms - credit monitoring. Here are some inexpensive or totally free methods you can secure yourself versus identity theft: Screen your credit reports totally free.

Check out AnnualCreditReport. com the only authorized site free of charge credit reports. If you want to monitor your reports over time, you can spread out your requests, getting one complimentary report every four months. Evaluation statements for your charge card, bank, retirement, brokerage, and other accounts each month. Or log in and examine them even more frequently.

Your Credit History - The Facts

A: You might order one, 2, or all three reports at the same time, or you might stagger your requests. It's your choice. Some monetary consultants state staggering your demands throughout a 12-month period may be a good way to watch on the precision and completeness of the details in your reports.

To maximize your rights under this law, get in touch with the credit reporting business and the details company. 1. Tell the credit reporting company, in writing, what details you believe is unreliable. Credit reporting companies must examine the products in question typically within one month unless they consider your dispute pointless.

After the information provider gets notice of a dispute from the credit reporting company, it needs to investigate, examine the pertinent information, and report the results back to the credit reporting company. If the details company discovers the disputed information https://consciouslifenews.com/the-growing-importance-of-credit-scores/11170911/ is incorrect, it needs to inform all three across the country credit reporting companies so they can fix the information in your file.

The Buzz on Free Credit Report

( This free report does not count as your yearly totally free report. credit score report.) If a product is changed or deleted, the credit reporting business can not put the contested information back in your file unless the info service provider validates that it is precise and complete. The credit reporting company likewise must send you composed notice that includes the name, address, and phone number of the info provider.

Tell the lender or other information provider in composing that you contest an item. Many companies specify an address for conflicts. If the supplier reports the item to a credit reporting company, it must consist of a notification of your dispute. And if you are appropriate that is, if the info is discovered to be incorrect the info supplier might not report it once again.

You also can ask the credit reporting business to supply your statement to anyone who got a copy of your report in the recent past. You can anticipate to pay a cost for this service. If you tell the information supplier that you challenge an item, a notice of your conflict need to be included any time the info provider reports the item to a credit reporting business.

The Ultimate Guide To Get A Free Credit Report

There is no time at all limit on reporting info about criminal convictions; information reported in response to your application for a task that pays more than $75,000 a year; and information reported due to the fact that you have actually obtained more than $150,000 worth of credit or life insurance (identity theft monitoring). Info about a lawsuit or an unsettled judgment versus you can be reported for seven years or till the statute of limitations runs out, whichever is longer.

Lenders, insurance companies, employers, and other organizations that use the details in your report to examine your applications for credit, insurance coverage, work, or leasing a house are among those that have a legal right to access your report. A: Your company can get a copy of your credit report only if you agree.

The FTC works for the consumer to prevent deceitful, deceptive, and unfair service practices in the marketplace and to supply information to help consumers area, stop, and avoid them. To file a grievance, visit ftc. gov/complaint or call 1-877-FTC-HELP (1-877-382-4357). The FTC goes into Web, telemarketing, identity theft, and other fraud-related grievances into Consumer Guard, a secure online database offered to numerous civil and criminal law enforcement agencies in the U.S.

Excitement About Creditwise From Capital One - Free Credit Score Report

A (Lock A locked padlock) or https:// implies you've safely connected to the. gov site. Share delicate details only on authorities, protected websites.

Your Credit Report provides information for lenders and others about how you make payments, https://www.easkme.com/2018/09/keep-track-credit-report-fix-errors.html your current and past credit mix, and whether your accounts are (or have been) in great standing. This information can assist identify the terms you're offered when you seek out new or more credit. Credit report can be intricate and considers a variety of factors that could affect your general creditworthiness.

It provides you insight into what you are doing well and provides guidelines on how to improve your credit. With a complimentary credit report from Experian, you can track your credit report development over time and get personalized informs when modifications occur. Under federal law you are entitled to a copy of your credit report annually from all three credit reporting firms - Experian, Equifax and TransUnion - as soon as every 12 months.

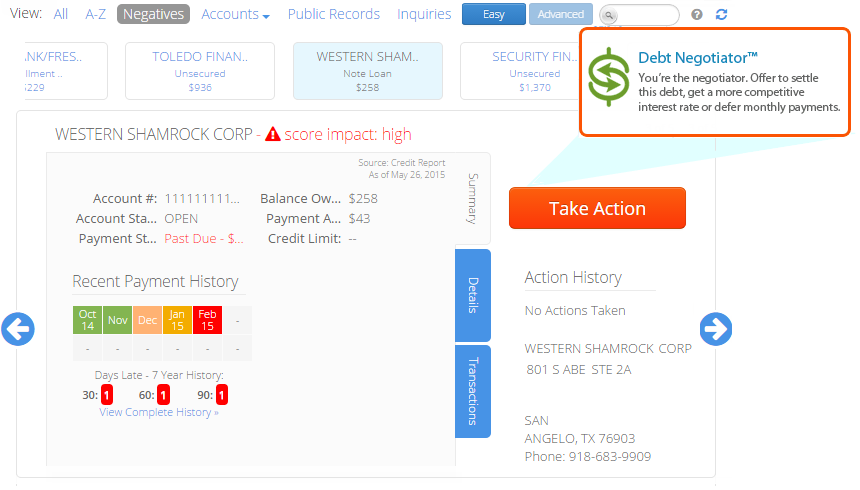

See This Report on Smartcredit.com: Get Your Credit Score Report

Checking out time: 2 minutes Credit https://en.search.wordpress.com/?src=organic&q=credit monitoring reports from the three nationwide credit bureaus do not normally contain credit history You might have the ability to get a credit rating from your charge card business, financial institution or loan declaration You can likewise utilize a credit score service or complimentary credit rating site Many people think if you examine your credit reports from the three across the country credit bureaus, you'll see credit history too.

When Excellent Credit Isn't Sufficient - How 61 Points Can Cost You Thousands

What does it require to improve your credit report? The alternative of preparing your finances and sticking to a fixed strategy is always a wise move. However, that is something that each and every person and service entity on the planet is going to do. How do you think you can improve your credit rating and credit report much faster?

This report will inform you absolutely nothing about what a lending institution would think of you if you went in to get a mortgage or new vehicle loan. Just a credit score report from the 3 credit bureaus TransUnion, Experian, Equifax can precisely offer you the info. Since you have a high debt ratio, that report will not state if your score may be low. When you go to a lending institution they will pull your report but what they are most interested in is the credit history. If you will get the loan however also whether or not you get the finest interest rates as well, that number determines not only.

In order to remove late payments on your credit report your have a number of options. Primary, you might do it yourself or second, you might let a praiseworthy credit restoration business with an A+ rating with the Better Company Bureau assist you while doing so. With a lot of business how do you understand which credit restoration company is best for you. Initially, you desire a business that is out there striving for your dollar and delivering on the services they promise. Some companies provide "low expense regular monthly alternatives" however it usually winds up costing you more money in the long run due to the fact that the company disputes just one product at a time.

Early detection is the key for stopping these activities. There is credit monitoring services at a minimal monthly cost. They notify their customer as soon as there is a modification in their credit report. Modifications might be a brand-new search on their customer by a card company, new loan application or brand-new payment established. The recipient of service can check his credit report anytime and discover his rating. It takes 100s of hours to arrange out any deceptive deal and might cost $100s of dollars. On top of it all the frustrations and concerns identity theft causes.

The law needs that you can get one free credit report from each of the 3 credit reporting companies each year. This legislation was introduced to help stem the increase in identity theft and monetary criminality. When you inspect your credit report online, do not forget to print a copy of every report from each reporting firm and store them in a safe place for future use.

The terrific thing is you can dispute credit report items on your own, free of charge, and conserve thousands of dollars in consulting charges. There is absolutely nothing that you can't do by yourself that credit therapists can do. So put in the time to find out how to rapidly raise your loan score, and you'll save a great deal of best free credit score cash.

Truthfully, it is a tedious procedure. Individuals will not be lying if they say that in order to erase personal bankruptcy from credit report, you might have to invest a great deal of your energy and time into it. Insolvency is without a doubt the hardest item to eliminate from a credit report. Typically, individuals would state that in order for you to eliminate bankruptcy from credit report, you would have to eliminate every other bad accounts from your report.

There is a certain quantity of dedication that features repairing and monitoring your credit report but the benefits significantly exceed the inconvenience. When it comes time for a big note to be gotten in into, it will be these steps that might conserve you cash, lower your rates of interest or enable for you to get a line of credit. Take control of your future and don't be fooled into investing numerous dollars on a credit repair work fraud or last minute expensive patchwork task for the loan you required the other day however are still waiting to protect. Don't relax, start now.good luck!

It's occurred to practically everybody I know. One minute you have your credit card/wallet/life in hand the next it's gone. Or you check your charge card statement and recognize there are charges on it that you didn't make. Initially there's a moment of panic, and then you leap into action. Although some steps might appear apparent, most individuals do not do everything they must to secure themselves after their charge card has actually been stolen.

It comes as not a surprise then that millions of people require dispute credit report repair. Society at big has motivated them to spend beyond their methods, and without any official credit training they have actually complied perfectly.

Take out your credit score report from the three credit bureaus. Evaluate and examine your report and make certain that you have a clear mind when attending to problems such as erroneous entries.

It's not your destiny to struggle with high interest rates for the rest of your life. Your score is just a breeze shot of your present economic strength. You can always deal with best credit report monitoring site it and improve.

Registering for a credit monitoring service is pointless if you're not doing anything to improve your credit report. You're paying cash on a monthly basis, but for absolutely nothing. Combine credit tracking with credit repair strategies and you'll see how well your hard work is paying off. For instance, credit tracking can assist you see if your credit report dispute and goodwill letters were in fact effective in having the information gotten rid of from your credit report.

The FCRA states that any and every info integrated in your credit report must be proven at any provided point of time. If the loan provider is not in a position to verify the exact same, the credit bureau is http://edition.cnn.com/search/?text=check credit score obligated by law to get rid of the information. This is become an extremely hassle-free loophole.

These are all categories you are likely to see and ought to understand when searching for items to disagreement. Account balance is the quantity owed on the loan. High balance is the most you ever owed on the loan. And date of last activity (DOLA) is the last date any account activity occurred.

These are the Experian, TransUnion, and EquiFax ratings. It is likewise a good idea to pay for the balances on any arrearage that you might have. That's why you need to monitor all 3 continually.

Try to get an installation type of loan or vehicle loan through your bank or cooperative credit union. Get your credit report and free scores they scream with a smile. Credit repair work does not require to by confusing.

When Terrific Credit Isn't Enough - How 61 Points Can Cost You Thousands

What does it require to improve your credit report? The alternative of preparing your finances and sticking to a repaired strategy is always a wise relocation. Nevertheless, that is something that each and every individual and business entity worldwide is going to do. How do you think you can improve your credit rating and credit report quicker?

This report will inform you nothing about what a loan provider would think about you if you went in to get a home mortgage or brand-new vehicle loan. Just a credit score report from the three credit bureaus TransUnion, Experian, Equifax can accurately offer you the information. That report will not mention if your rating might be low because you have a high debt ratio. When you go to a lending institution they will pull your report but what they are most thinking about is the credit rating. If you will get the loan however also whether or not you get the best interest rates as well, that number figures out not only.

In order to remove late payments on your credit report your have a number of options. Primary, you might do it yourself or second, you might let a creditable credit repair company with an A+ ranking with the Bbb help you while doing so. With a lot of business how do you know which credit remediation business is best for you. Initially, you desire a business that is out there striving for your dollar and delivering on the services they guarantee. Some business offer "low cost monthly alternatives" however it generally ends up costing you more cash in the long run because the company disputes only one item at a time.

Early detection is the key for stopping these activities. There is credit monitoring services at a minimal regular monthly cost. They notify their client as quickly as there is a change in their credit report. Modifications might be a brand-new search on their customer by a card business, new loan application or new payment established. The recipient of service can check his credit report anytime and discover out his rating. It takes 100s of hours to figure out any deceptive transaction and might cost $100s of dollars. On top of all of it the frustrations and concerns identity theft triggers.

The law requires that you can get one complimentary credit report from each of the 3 credit reporting agencies annually. This legislation was presented to assist stem the rise in identity theft and monetary criminality. When you check your credit report online, do not forget to print a copy of every report from each reporting firm and shop them in a safe location for future use.

The fantastic thing is you can dispute credit report items by yourself, totally free, and conserve countless dollars in consulting charges. There is definitely nothing that you can't do on your own that credit therapists can do. So make the effort to learn how to rapidly raise your loan ranking, and you'll save a lot of money.

Honestly, it is a tiresome procedure. People will not be lying if they say that in order to erase personal bankruptcy from credit report, you might need to invest a great deal of your energy and time into it. Bankruptcy is without a doubt the hardest item to get rid of from a credit report. Often, individuals would say that in order for you to remove insolvency from credit report, you would have to remove every other bad accounts from your report.

There is a specific quantity of devotion that features fixing and monitoring your credit report but the benefits considerably outweigh the inconvenience. When it comes time for a large note to be gotten in into, it will be these actions that might conserve you cash, lower your rates of interest or enable you to get a line of credit. Take control of your future and do not be deceived into investing numerous dollars on a credit repair work rip-off or last minute expensive patchwork task for the loan you needed the other day however are still waiting to protect. Do not relax, begin now.good luck!

It's happened to nearly everybody I understand. One minute you have your credit card/wallet/life in hand the next it's gone. Or you examine your credit card declaration and recognize there are charges on it that you didn't make. Initially there's a minute of panic, and after that you leap into action. Although some actions might seem apparent, the majority of people do not do whatever they should to protect themselves after their credit card has been taken.

It comes as not a surprise then that millions of individuals need dispute credit report repair work. Society at big has encouraged them to spend beyond their means, and without any official credit training they have actually complied perfectly.

Pull out your credit score report from the 3 credit bureaus. When addressing issues such as erroneous entries, examine and assess your report and make sure that you have a clear mind.

It's not your destiny to struggle with high interest rates for the rest of your life. Your score is only a breeze shot of your present financial strength. You can constantly deal with it and enhance.

If you're not doing anything to improve your credit score, subscribing to a credit monitoring service is pointless. You're paying cash monthly, but for nothing. Integrate credit tracking with credit repair work techniques and you'll see how well your difficult work is paying off. For example, credit tracking can help you see if your credit report dispute and goodwill letters were really effective in having actually the details eliminated from your credit report.

The FCRA says that any and every information included in your credit report must be verifiable at any given point of time. The credit bureau is bound by law to remove the information if the lending institution is not in a position to verify the same. This is best credit report monitoring become an extremely convenient loophole.

These are all categories you are most likely to see and must comprehend when trying to find products to dispute. Account balance is the amount owed on the loan. High balance is the most you ever owed on the loan. And date of last activity (DOLA) is the last date any account activity occurred.

These are the Experian, TransUnion, and EquiFax scores. It is also credit monitoring vs identity theft protection sensible to pay for the balances on any outstanding financial obligation that you might have. That's why you need to monitor all three continuously.

Attempt to get an installment kind of loan or auto loan through your bank or credit union. Get your credit report and complimentary scores they yell with a smile. Credit repair work does not need to by puzzling.